China’s Hidden Victory: How Material Power Was Built from a Property Bust

For two decades, China’s real estate boom drove unprecedented levels of urban development and global commodity demand.

At its height, China consumed over half the world’s steel output, imported billions of tonnes of iron ore, copper, and coal, and created entire cities at a pace never before seen in human history.

When the property market collapsed under its own weight, Western commentators framed it as a monumental financial failure.

But a closer, more material analysis reveals a very different reality:

While financial capital has been lost, physical capital - steel, copper, aluminium, infrastructure - remains deeply embedded inside China.

Today, as global tensions rise, it is becoming clear that the so-called property bust has left behind a strategic material foundation - one that China can now mobilise for both economic growth and, if necessary, prolonged strategic competition.

Material Wealth vs Financial Loss: Making Sense of the Numbers

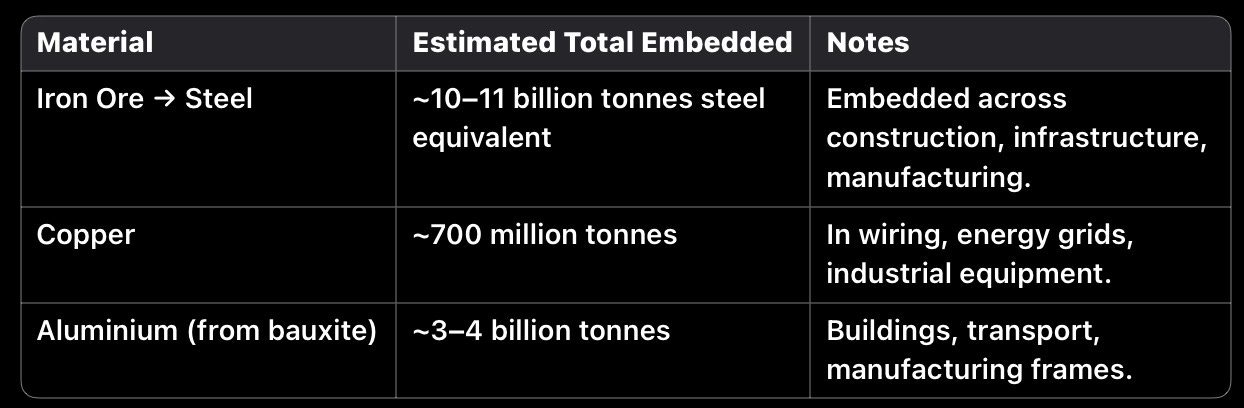

Between 2000 and 2023, China imported and embedded:

Even accounting for usage, decay, and inaccessibility, China’s recoverable stockpile from abandoned or obsolete structures is conservatively estimated at:

200–300 million tonnes of scrap steel,

10–15 million tonnes of copper,

30–40 million tonnes of aluminium.

Meanwhile, Western investors - through offshore bond purchases, mining expansions, commodity speculation, and logistics infrastructure - absorbed the financial risk, with estimated cumulative Western losses exceeding £190–200 billion.

China internalised the material wealth. The West externalised the financial risk.

Recycling Activation: Quiet Mobilisation of Strategic Resources

In the last three years, a clear shift has begun inside China:

Mass demolitions of abandoned and incomplete developments are underway across Inner Mongolia, Hebei, Hunan, and elsewhere.

Scrap metal recovery surged by 15% in 2023, with over 300 million tonnes of steel scrap processed.

State-backed expansion of recycling hubs and industrial material recovery facilities is accelerating, often under the banner of “urban renewal” and “green development.”

Export controls on key strategic minerals (gallium, germanium, graphite) have tightened, suggesting a policy shift towards domestic resource consolidation.

This is not just economic policy.

It is a systematic conversion of stranded, surplus material into strategic industrial capacity.

Industrial Flexibility: Peace or Conflict, Growth or Rearmament

The implications are profound.

China’s internal material reserves and growing recycling-industrial system mean it can:

Fuel continued economic growth without relying heavily on new commodity imports.

Maintain military production across multiple theatres if conflicts emerge.

Withstand blockades or sanctions by reprocessing stockpiled steel, copper, and aluminium.

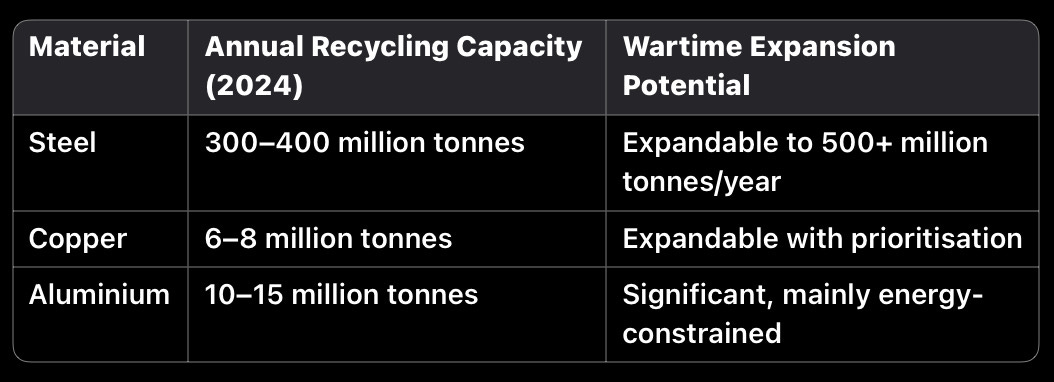

Reprocessing capacity is significant:

Even under full mobilisation conditions, China could theoretically sustain a multi-theatre industrial war economy for five to ten years without immediate fresh external supply.

At the same time, in peacetime, this same material capacity underpins:

Renewable energy expansion,

Electric vehicle manufacturing,

Advanced heavy industry redevelopment.

The Western Reality: Fragility Beneath the Façade

In contrast, the Western industrial base has eroded:

Heavy manufacturing in decline across steel, shipbuilding, armoured vehicles.

Material dependency on fragile and vulnerable supply chains for critical resources.

Financial systems prioritising speculative profits over material resilience.

The United States maintains technological edge in design and innovation.

But its capacity to sustain long-duration industrial competition or warfare is degraded compared to Cold War standards.

Europe faces even sharper vulnerabilities:

energy insecurity, declining heavy industry, and limited raw material sovereignty - though Europe seems to have woken up as has Starmer.

Financial assets can be revalued.

Material assets must be rebuilt - slowly, at great cost, and often too late.

Conclusion: Material Reality Will Define the 21st Century

China’s property boom was not simply reckless speculation.

It was, in material terms, a massive accumulation of industrial resources - largely paid for by external capital flows.

Today, China holds:

The largest embedded stockpile of steel, copper, and aluminium in human history,

The recycling and industrial base to reactivate it,

The manufacturing systems to deploy it strategically.

Whether peace holds or conflict emerges,

China is positioned to leverage this material strength for both internal growth and external strategic advantage.

While the West speculated, China built.

While the West exported financial risk, China imported material power.

In the new age of competition, material resilience - not paper wealth - will decide outcomes.